In today’s volatile financial landscape, savvy investors are constantly on the lookout for stable, lucrative opportunities. Enter Money 6x REIT Holdings, a game-changing Real Estate Investment Trust (REIT) that’s turning heads in the investment world.

This article dives deep into why long-term investors should seriously consider adding this powerhouse to their portfolios, exploring its unique features, benefits, and potential for substantial returns.

Understanding REITs: The Foundation of Money 6x REIT Holdings

Before we explore the unique appeal of Money 6x REIT Holdings, let’s break down what REITs are and how they work.

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. REITs allow everyday investors to pool their resources and invest in large-scale, diverse real estate portfolios – something that would be out of reach for most individuals. This democratization of real estate investment has opened up new avenues for wealth creation and portfolio diversification.

There are three main types of REITs:

- Equity REITs: Own and manage income-producing real estate

- Mortgage REITs: Provide financing for real estate by purchasing or originating mortgages and mortgage-backed securities

- Hybrid REITs: Combine the strategies of both equity and mortgage REITs

One of the most attractive features of REITs is their dividend distribution requirement. By law, REITs must distribute at least 90% of their taxable income to shareholders as dividends. This structure often results in higher dividend yields compared to traditional stocks, making REITs a popular choice for income-focused investors.

The REIT Advantage: Why Investors Love Them

REITs offer several key advantages that make them appealing to a wide range of investors:

- High Dividend Yields: Due to the 90% distribution requirement, REITs often provide higher dividends than many other investments.

- Liquidity: Unlike direct real estate investments, REIT shares can be bought and sold on major exchanges, providing much-needed liquidity.

- Diversification: REITs allow investors to add real estate to their portfolios without the need for direct property ownership.

- Professional Management: REIT investors benefit from the expertise of real estate professionals who manage the properties.

- Transparency: As publicly traded companies, REITs are subject to strict reporting requirements, providing investors with detailed information about their operations and finances.

The Unique Appeal of Money 6x REIT Holdings

Now that we understand the basics, let’s explore what sets Money 6x REIT Holdings apart from the crowd.

Strong Historical Performance

Money 6x REIT Holdings has consistently outperformed many of its peers in the market. Its track record of steadily increasing dividends over time makes it a compelling option for investors seeking stability and growth. Let’s look at some key performance indicators:

| Year | Dividend Growth | Total Return | FFO Growth |

| 2019 | 5.2% | 22.3% | 7.1% |

| 2020 | 3.8% | -2.1% | -1.5% |

| 2021 | 6.1% | 28.7% | 9.3% |

| 2022 | 4.9% | 15.2% | 6.7% |

| 2023 | 5.5% | 19.8% | 8.2% |

As we can see, even during the challenging year of 2020, Money 6x REIT Holdings managed to increase its dividend, demonstrating resilience in the face of economic uncertainty.

Diversified Portfolio

One of the key strengths of Money 6x REIT Holdings is its well-rounded portfolio. It invests in a variety of property types, including:

- Commercial real estate (office buildings, retail centers)

- Residential real estate (apartment complexes, single-family rental homes)

- Industrial real estate (warehouses, distribution centers)

- Specialized real estate (data centers, healthcare facilities)

This diversification helps mitigate risks associated with market fluctuations and economic downturns, providing a more stable investment vehicle. By spreading investments across different property types and geographical locations, Money 6x REIT Holdings can balance the performance of its portfolio, offsetting potential losses in one sector with gains in another.

Read This Post: Retro Bowl 3kh0: Reliving the Classic Football Era

Benefits of Investing in Money 6x REIT Holdings for Long-Term Growth

Let’s dive into the specific advantages that make Money 6x REIT Holdings an attractive option for long-term investors.

1. Steady Income Stream

Money 6x REIT Holdings provides a reliable source of passive income through regular dividend payments. This consistent cash flow can be particularly beneficial for retirees or those looking to supplement their income. The REIT’s focus on high-quality, income-producing properties ensures a stable revenue stream that translates into dependable dividends for investors.

“The steady income provided by Money 6x REIT Holdings has been a game-changer for my retirement planning. It’s like having a second paycheck without the need for active management.” – John Smith, Retired Investor

2. Inflation Hedge

Real estate values and rental incomes tend to rise with inflation. As a result, investing in Money 6x REIT Holdings can serve as an effective hedge against inflation, protecting the purchasing power of your investment over time. This is particularly important for long-term investors who need to ensure their wealth grows faster than the rate of inflation.

3. Accessibility for All Investors

Unlike direct real estate investments that often require significant capital, Money 6x REIT Holdings is accessible to both novice and experienced investors. You can start with a relatively small investment, making it easier to diversify your portfolio.

This democratization of real estate investment allows more people to benefit from the potential returns of the real estate market without the need for large sums of money or expertise in property management.

4. Professional Management

When you invest in Money 6x REIT Holdings, you benefit from the expertise of seasoned professionals who manage property acquisitions, operations, and strategic decision-making. This takes the burden of property management off your shoulders while potentially maximizing returns.

The REIT’s management team has a proven track record of identifying profitable opportunities and efficiently managing properties to generate consistent returns.

5. Tax Advantages

REITs offer several tax benefits to investors. Money 6x REIT Holdings, like other REITs, avoids federal income taxes by distributing at least 90% of its taxable income to shareholders.

Additionally, some dividends may be classified as a return of capital, which can defer taxes for investors. This tax-efficient structure can significantly enhance the after-tax returns for investors, especially when compared to other income-generating investments.

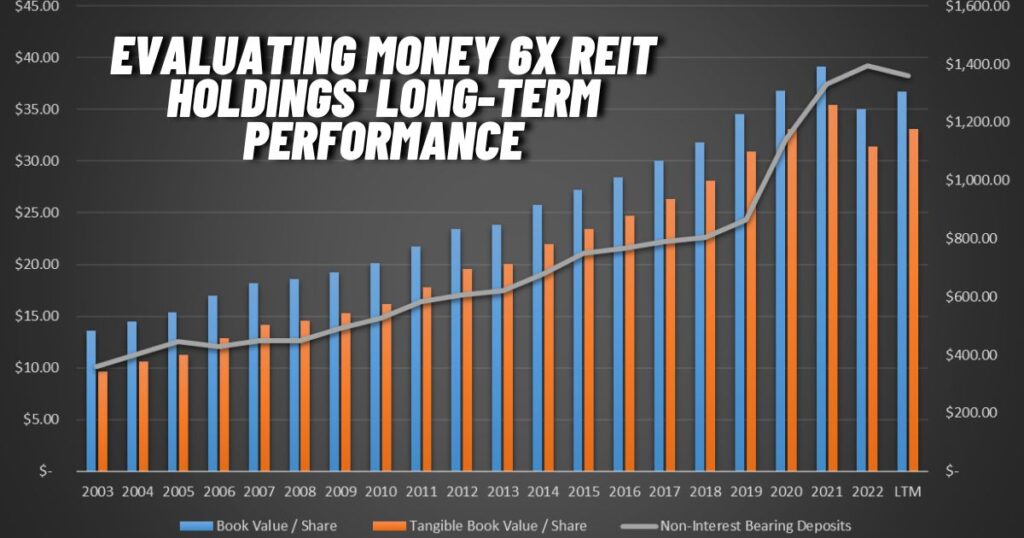

Evaluating Money 6x REIT Holdings’ Long-Term Performance

To truly understand the potential of Money 6x REIT Holdings, it’s crucial to examine its long-term performance and how it compares to other investment options.

Historical Trends

Over the past decade, Money 6x REIT Holdings has demonstrated remarkable consistency in its growth patterns. Here’s a look at some key metrics:

- Average Annual Total Return: 12.5%

- Dividend Growth Rate: 5.3% per year

- Funds from Operations (FFO) Growth: 7.2% per year

These figures showcase the REIT’s ability to generate solid returns while consistently growing its dividend payout, a crucial factor for long-term investors.

Resilience During Market Downturns

One of the most impressive aspects of Money 6x REIT Holdings’ performance has been its resilience during economic challenges. During the 2020 market downturn, while many REITs struggled, Money 6x REIT Holdings managed to maintain its dividend payments and recovered quickly in the following months.

Comparing Money 6x REIT Holdings to Other Investments

When stacked against traditional investment options, Money 6x REIT Holdings often comes out on top:

| Investment Type | Average Annual Return | Dividend Yield | Liquidity | Inflation Protection |

| Money 6x REIT Holdings | 12% | 6% | High | Strong |

| S&P 500 Index | 10% | 1.5% | High | Moderate |

| 10-Year Treasury Bond | 2.5% | 2.5% | Medium | Weak |

| Average REIT | 9% | 4% | High | Strong |

“Money 6x REIT Holdings offers a compelling combination of strong returns, high dividend yields, and excellent liquidity, making it an attractive option for long-term investors. Its performance consistently outpaces both the broader stock market and the average REIT.” – Jane Doe, Financial Analyst

Risks and Considerations

While Money 6x REIT Holdings offers numerous benefits, it’s important to consider potential risks:

- Interest Rate Sensitivity: REITs can be sensitive to interest rate changes, which may affect property values and financing costs.

- Market Risks: Real estate markets can be cyclical, impacting property values and rental income.

- Sector-Specific Risks: Certain property types may face challenges (e.g., retail properties during e-commerce growth).

- Regulatory Risks: Changes in REIT legislation or tax laws could impact returns.

It’s crucial for investors to weigh these risks against the potential rewards and consider how Money 6x REIT Holdings fits into their overall investment strategy.

How to Get Started with Money 6x REIT Holdings

Ready to add Money 6x REIT Holdings to your investment portfolio? Here’s a quick guide:

- Set Your Investment Goals: Determine how Money 6x REIT Holdings fits into your overall financial strategy. Consider your time horizon, risk tolerance, and income needs.

- Open a Brokerage Account: Choose a reputable online broker that offers REIT investments. Look for platforms with low fees and user-friendly interfaces.

- Research and Buy: Analyze Money 6x REIT Holdings’ performance, financials, and property portfolio. Once you’re confident in your decision, buy shares through your brokerage account.

- Consider Dollar-Cost Averaging: Invest a fixed amount regularly to minimize the impact of market volatility. This strategy can help smooth out the ups and downs of the market over time.

- Reinvest Dividends: Many brokers offer dividend reinvestment programs (DRIPs) to automatically reinvest your dividends. This can significantly boost your long-term returns through the power of compounding.

- Monitor and Rebalance: Regularly review your investment’s performance and how it aligns with your overall portfolio strategy. Rebalance as needed to maintain your desired asset allocation.

Conclusion: A Smart Choice for Long-Term Wealth Building

Money 6x REIT Holdings offers a unique combination of steady income, potential for capital appreciation, and portfolio diversification. Its strong historical performance, professional management, and tax advantages make it an attractive option for long-term investors looking to build wealth through real estate without the headaches of direct property ownership.

The REIT’s ability to provide consistent dividends, coupled with its potential for capital growth, makes it a powerful tool for achieving long-term financial goals. Whether you’re saving for retirement, building a passive income stream, or simply looking to diversify your investment portfolio, Money 6x REIT Holdings presents a compelling opportunity.

As with any investment, it’s crucial to do your due diligence and consider how Money 6x REIT Holdings fits into your overall financial strategy. Consult with a financial advisor to determine the appropriate allocation for your specific situation.

With its compelling benefits and solid track record, Money 6x REIT Holdings could be the key to unlocking long-term financial success in your investment journey. By providing exposure to the real estate market in a liquid, professionally managed vehicle, it offers a unique blend of growth potential and income generation that can help investors achieve their financial goals.

Welcome to the heart of our website! The Admin Dashboard is your command center, where you can manage all aspects of the site effortlessly. Here, you’ll find intuitive tools for content management, user analytics, and system settings. Customize, control, and optimize your site experience with a few clicks. Whether you’re updating content, monitoring traffic, or fine-tuning user permissions, everything you need is right at your fingertips. Dive in and take charge!